Life gets a little fancier with Trust+

Trust+Level up to new banking experiences with Trust+. Simply maintain min. S$100K eligible balances across your Trust savings account Average Daily Balance ("ADB") and/or your TrustInvest account value.

Choose from 3 plans and enjoy up to 2.4% p.a. interest on your deposit. Learn more.

Extra privileges

Unlock specially curated experiences

Metal card

Exquisitely crafted for your elevated experience

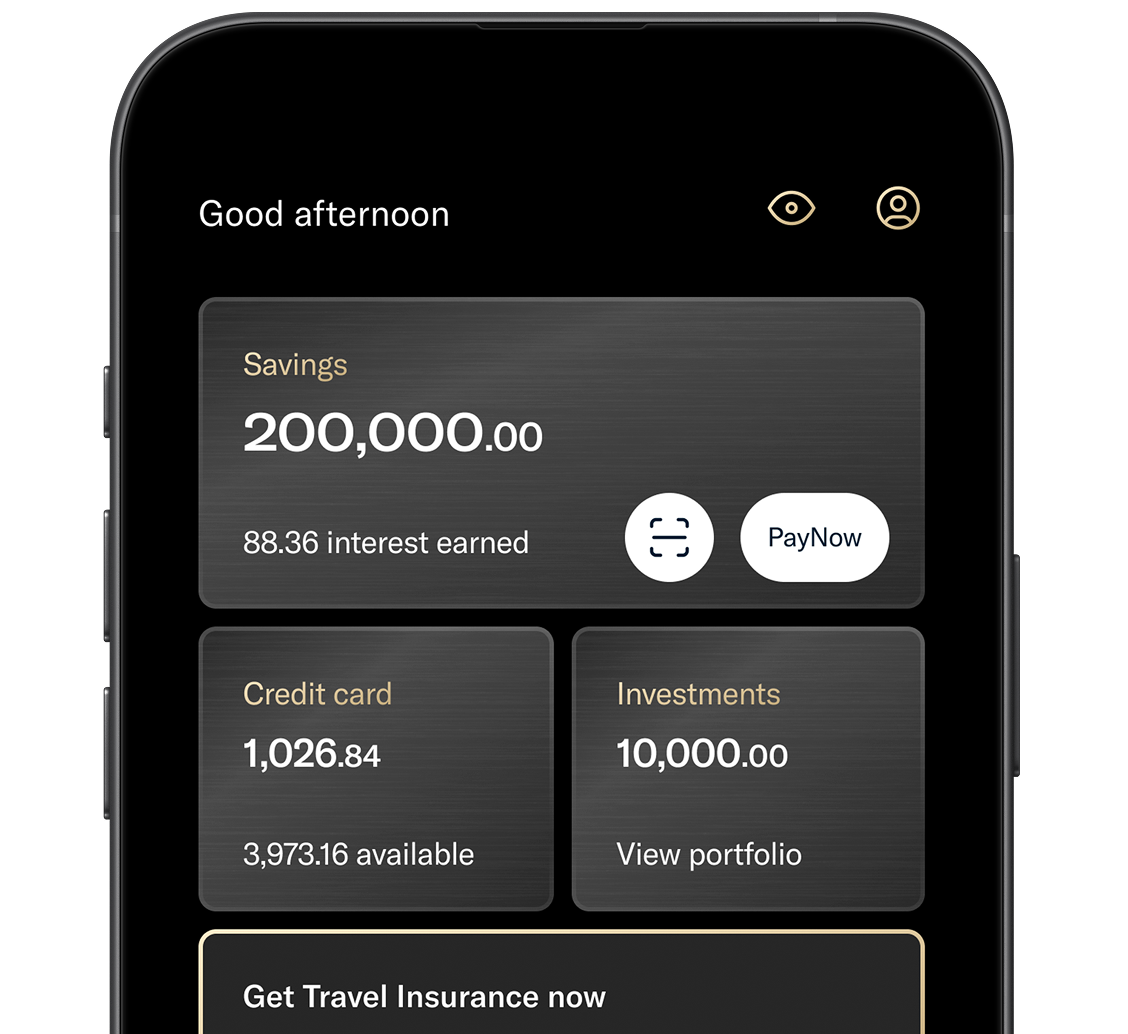

Special theme

Elegant in-app enhancements

VIP support

Priority in-app customer service

Savings calculator

Select plan

Flex

Signature

Zen

Deposit balance (S$)

Choose and achieve any 3 bonus interest every month:

0.05% p.a.

Base rate

Default

+1.20% p.a.

Refer a new credit card customer who successfully signs up

+0.70% p.a.

Purchase total S$20K of eligible TrustInvest funds

+0.45% p.a.

Credit min. S$1,500 monthly salary via GIRO

+0.30% p.a.

Keep min. S$100K Average Daily Balance (ADB)

+0.20% p.a. (NTUC Union Member)

Make min. 5 x S$30 debit/credit card spends

+0.10% p.a. (non-Union Member)

Make min. 5 x S$30 debit/credit card spends

+0.20% p.a.

Increase ADB by S$3K from previous month

+0.15% p.a.

Receive a total of S$1,500 incoming PayNow

+0.15% p.a.

Spend a total of S$500 in foreign currency

What you'll earn on

S$1,200,000 deposits in a month

Trust0.00% p.a. on first S$1.2M*

0.00% p.a. on first S$1.2M*S$0.00

Other savings account0.05% p.a.

0.05% p.a.S$0.00

*Interest rate of 0.05% p.a. applies for balances above S$1.2M. Calculations are simplified for illustration purposes.

Curated privileges

More to come

Experience metal

Exquisitely crafted with exclusive privileges

Special Theme

An elegant black and gold in-app theme, specially crafted for your elevated experience.

VIP support

Need a helping hand with your banking matters? Enjoy 24/7 priority access to our customer care experts via Trust App.

Have questions?

We have answers

Deposit Insurance Scheme

Singapore dollar deposits of non-bank depositors are insured by the Singapore Deposit Insurance Corporation, for up to S$100,000 in aggregate per depositor per Scheme member by law. Foreign currency deposits, dual currency investments, structured deposits and other investment products are not insured.

General Disclaimer for TrustInvest

All investments involve risks, including the possible loss of all or part of your original investment amount. Past performance are not indicative of future performance.