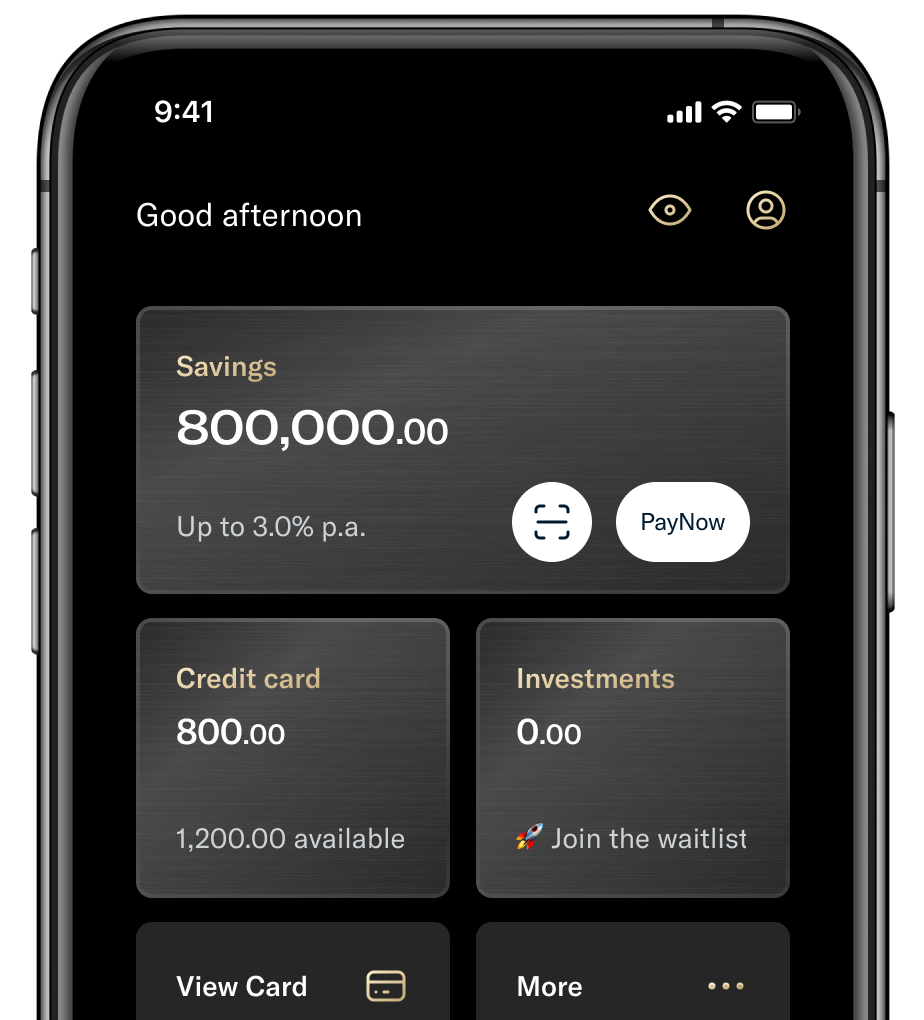

Level up to 3.00% p.a.

Interest on first S$800K deposit. That’s 0.75% more than our usual interest rate

Deposit balance (S$)

I keep min. S$100K Average Daily Balance

I make min. 5 x S$30 card spends each month

I credit min. S$1,500 monthly salary via GIRO

I am a NTUC Union Member

Total interest you can earn on S$800,000 in 1 month

Trust+

0.00% p.a. on first S$800K* S$0.00

Other savings account

0.05% p.a. S$0.00

*Interest rate of 0.05% p.a. applies for balances above S$800K. Calculations are simplified for illustration purposes.

Special Theme

An elegant black and gold in-app theme, specially crafted for your elevated experience.

Curated privileges

Experience metal

Exquisitely crafted with exclusive privileges