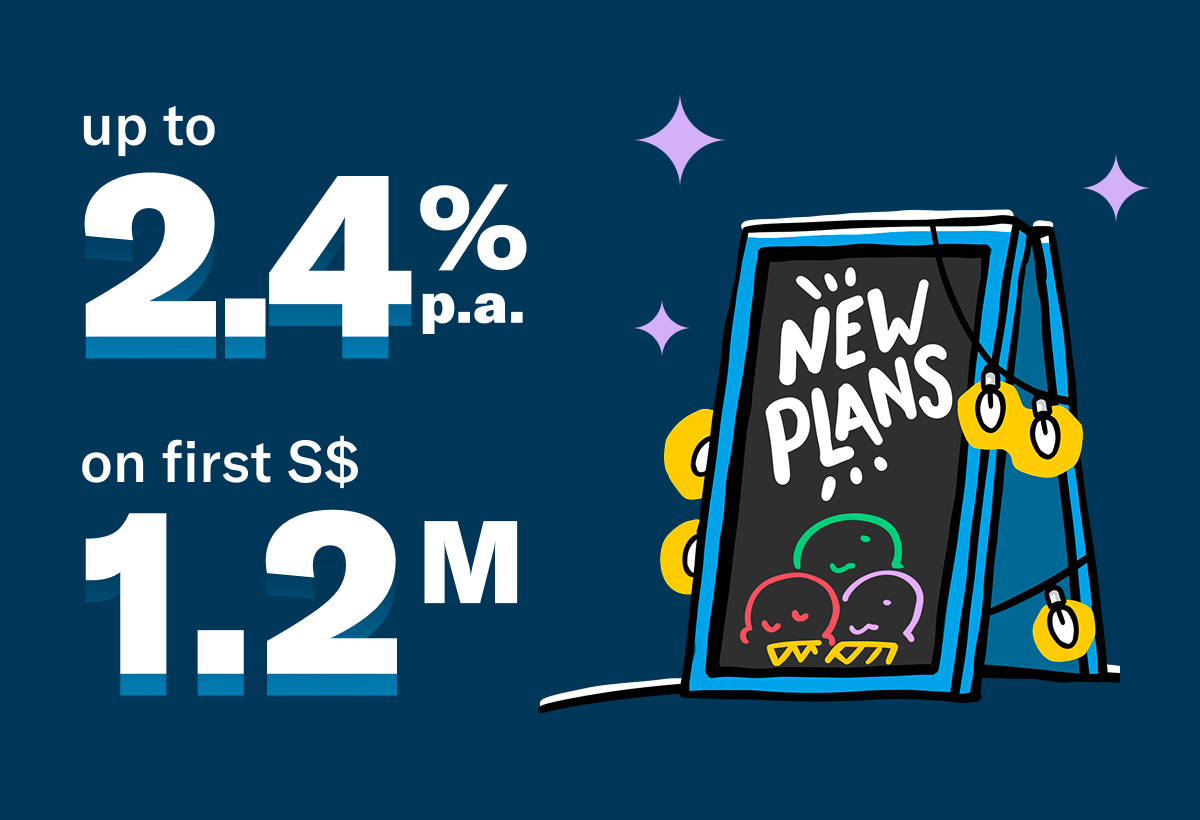

Your savings,your choiceEarn up to 2.40% p.a. interest on deposits up to S$1.2M. Our savings account now offers 3 plans. Choose how you earn interest and switch plans every month if you like!

🍦Sweeter savings start here

Choose a plan to grow your savings your way!

Flex plan

up to 2.40% p.a.

Build your ideal savings plan! Choose any 3 bonus interest from 8 available options

Signature plan

up to 1.00% p.a.

Enjoy bonus interest when you earn, spend or save. Lower rates apply for non-union members

Flex plan with up to 2.40% p.a. Choose any 3 scoops

Choose any 3 scoops

Each scoop is a bonus interest. Choose your favourite 3 and earn bonus interest when you achieve them each month!

start with 0.10% p.a. base rate

Invest Bonus Rate

Purchase new investments of min. S$20K total in eligible funds via TrustInvest*.

Eligible funds exclude Cash+ funds. Your buy orders need to be executed by the second last business day of the month to unlock this bonus for the month.

*The funds invested and money in your investment account are not insured by SDIC. The money in your investment account does not earn any interest.

Bonus interest applies for the full month, regardless of when you unlock it.

Referral Bonus Rate

Refer at least one new Trust credit card customer each month to unlock this bonus. This new customer must successfully sign up during the month using your referral code.

Bonus interest applies for the full month, regardless of when you unlock it.

FX Spend Bonus Rate

Make at least S$500 total foreign currency card spends posted within the month to unlock this bonus.

Bonus interest applies for the full month, regardless of when you unlock it.

Incoming PayNow Bonus Rate

Receive at least S$1,500 in total incoming PayNow transfers to your Trust savings account to unlock this bonus.

Bonus interest applies for the full month, regardless of when you unlock it.

+0.05% p.a. base rate

with these scoops you can earn up to 2.40% p.a.

Salary Bonus Rate

Credit min. S$1,500 monthly salary via GIRO with purpose code SALA in a single transaction. Salary credited through FAST will not be eligible.

Bonus interest applies for the full month, regardless of when you unlock it.

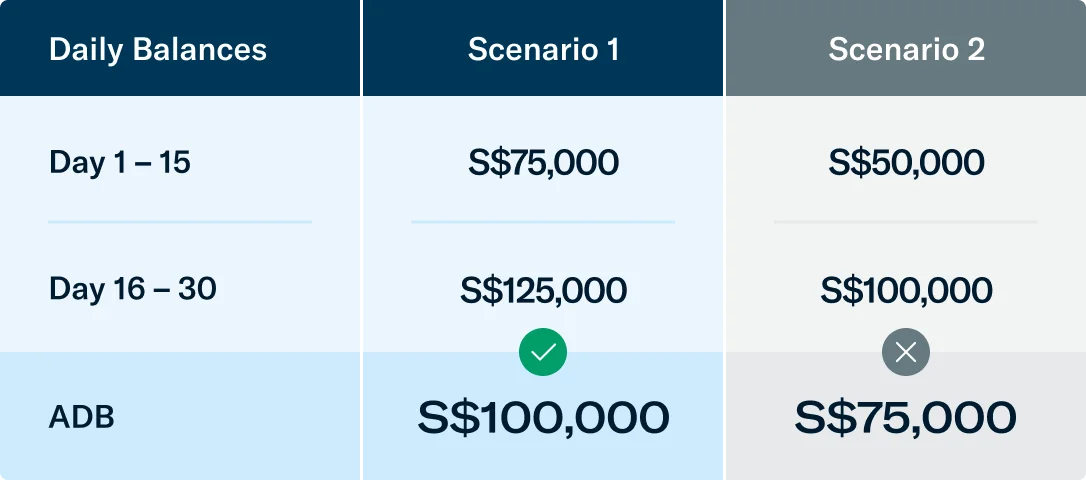

Balance Bonus Rate

Maintain a min. S$100K Average Daily Balance (ADB) for the month to unlock this bonus.

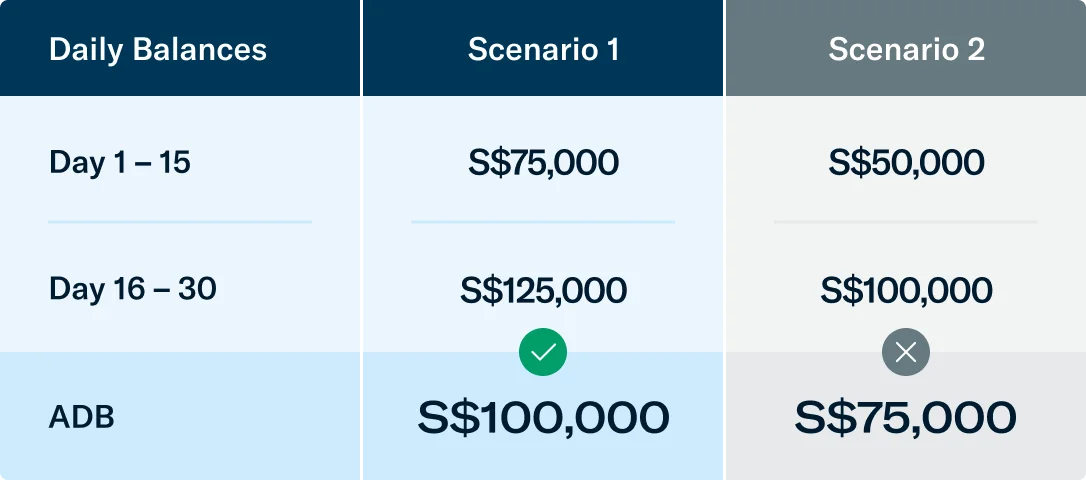

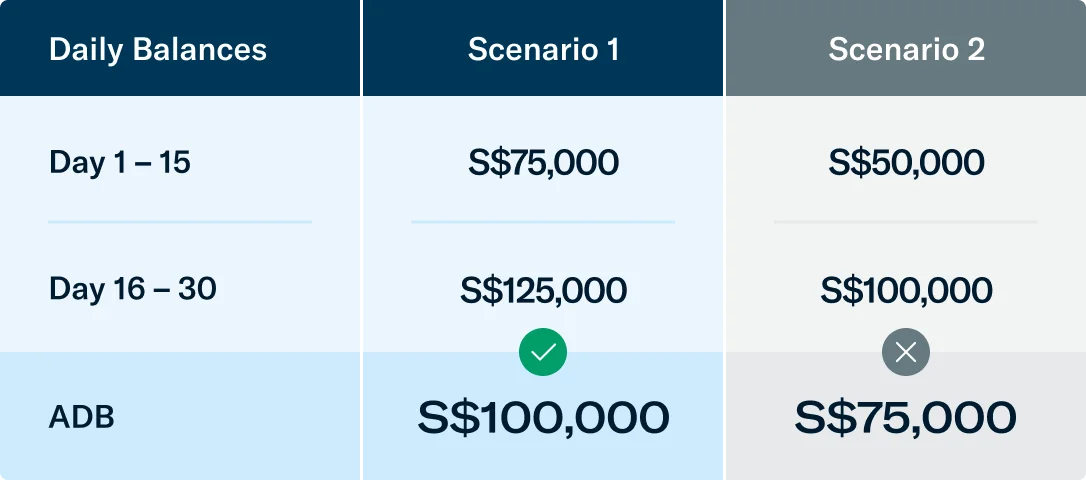

Average Daily Balance is the sum of daily balances divided by the number of days in the month. Please note that this is not the same as the end-of-month balance.

Spend Bonus Rate

Make at least 5 qualifying debit/credit card spends (min. S$30 each) posted within the month to unlock this bonus.

NTUC Union Members get 0.20% p.a. while others get 0.10% p.a.

Bonus interest applies for the full month, regardless of when you unlock it.

Savings Increase Bonus Rate

Increase your savings account’s Average Daily Balance (ADB) by at least S$3K from the previous month’s ADB to unlock this bonus.

Average Daily Balance is the sum of daily balances divided by the number of days in the month. Please note that this is not the same as the end-of-month balance.

Bonus interest applies for the full month, regardless of when you unlock it.

Referral Bonus Rate

Refer at least one new Trust credit card customer each month to unlock this bonus. This new customer must successfully sign up during the month using your referral code.

Bonus interest applies for the full month, regardless of when you unlock it.

Invest Bonus Rate

Purchase new investments of min. S$20K total in eligible funds via TrustInvest*.

Eligible funds exclude Cash+ funds. Your buy orders need to be executed by the second last business day of the month to unlock this bonus for the month.

*The funds invested and money in your investment account are not insured by SDIC. The money in your investment account does not earn any interest.

Bonus interest applies for the full month, regardless of when you unlock it.

Salary Bonus Rate

Credit min. S$1,500 monthly salary via GIRO with purpose code SALA in a single transaction. Salary credited through FAST will not be eligible.

Bonus interest applies for the full month, regardless of when you unlock it.

Balance Bonus Rate

Maintain a min. S$100K Average Daily Balance (ADB) for the month to unlock this bonus.

Average Daily Balance is the sum of daily balances divided by the number of days in the month. Please note that this is not the same as the end-of-month balance.

Savings Increase Bonus Rate

Increase your savings account’s Average Daily Balance (ADB) by at least S$3K from the previous month’s ADB to unlock this bonus.

Average Daily Balance is the sum of daily balances divided by the number of days in the month. Please note that this is not the same as the end-of-month balance.

Bonus interest applies for the full month, regardless of when you unlock it.

Incoming PayNow Bonus Rate

Receive at least S$1,500 in total incoming PayNow transfers to your Trust savings account to unlock this bonus.

Bonus interest applies for the full month, regardless of when you unlock it.

Spend Bonus Rate

Make at least 5 qualifying debit/credit card spends (min. S$30 each) posted within the month to unlock this bonus.

NTUC Union Members get 0.20% p.a. while others get 0.10% p.a.

Bonus interest applies for the full month, regardless of when you unlock it.

FX Spend Bonus Rate

Make at least S$500 total foreign currency card spends posted within the month to unlock this bonus.

Bonus interest applies for the full month, regardless of when you unlock it.

Signature plan with up to 1.00% p.a.

Earn bonus interest when you save, spend or credit your salary.

start with 0.10% p.a. base rate

Spend Bonus Rate

Make at least 5 qualifying debit/credit card spends (min. S$30 each) posted within the month to unlock this bonus.

NTUC Union Members get 0.20% p.a. while others get 0.10% p.a.

Bonus interest applies for the full month, regardless of when you unlock it.

+0.05% p.a. base rate

Salary Bonus Rate

Credit min. S$1,500 monthly salary via GIRO with purpose code SALA in a single transaction. Salary credited through FAST will not be eligible.

Bonus interest applies for the full month, regardless of when you unlock it.

Balance Bonus Rate

Maintain a min. S$100K Average Daily Balance (ADB) for the month to unlock this bonus.

Average Daily Balance is the sum of daily balances divided by the number of days in the month. Please note that this is not the same as the end-of-month balance.

Zen plan with flat 0.40% p.a.

Grow your savings fuss-free. No strings attached!

Savings calculator

Select plan

Flex

Signature

Zen

Deposit balance (S$)

Choose and achieve any 3 bonus interest every month:

0.05% p.a.

Base rate

Default

+1.20% p.a.

Refer a new credit card customer who successfully signs up

+0.70% p.a.

Purchase total S$20K of eligible TrustInvest funds

+0.45% p.a.

Credit min. S$1,500 monthly salary via GIRO

+0.30% p.a.

Keep min. S$100K Average Daily Balance (ADB)

+0.20% p.a. (NTUC Union Member)

Make min. 5 x S$30 debit/credit card spends

+0.10% p.a. (non-Union Member)

Make min. 5 x S$30 debit/credit card spends

+0.20% p.a.

Increase ADB by S$3K from previous month

+0.15% p.a.

Receive a total of S$1,500 incoming PayNow

+0.15% p.a.

Spend a total of S$500 in foreign currency

What you'll earn on

S$1,200,000 deposits in a month

Trust0.00% p.a. on first S$1.2M*

0.00% p.a. on first S$1.2M*S$0.00

Other savings account0.05% p.a.

0.05% p.a.S$0.00

*Interest rate of 0.05% p.a. applies for balances above S$1.2M. Calculations are simplified for illustration purposes.

🗓️ Change your plan every month

If you don't choose any plan, you’ll automatically get the Signature plan. Prefer Flex plan or Zen plan instead? Sure thing! Just make the change via Trust App. Plus, you can even change your plan every month if you like. For full details, see our Key Facts Sheet.

- Lock in period

- Monthly fee

- Minimum balance

- Account closure fee

- Foreign transaction fee

- Card replacement fee

Fee-less

savings account

FEES

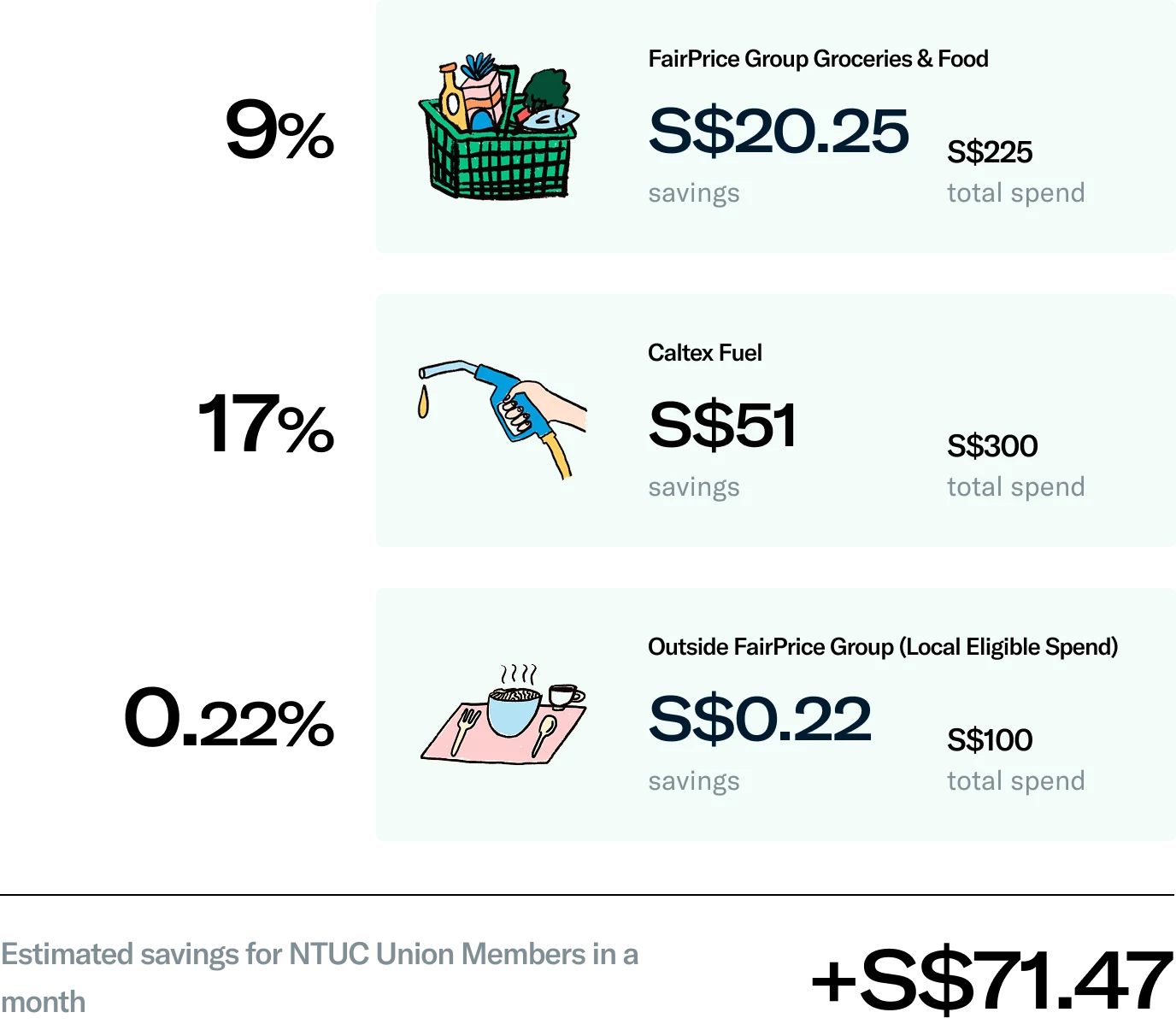

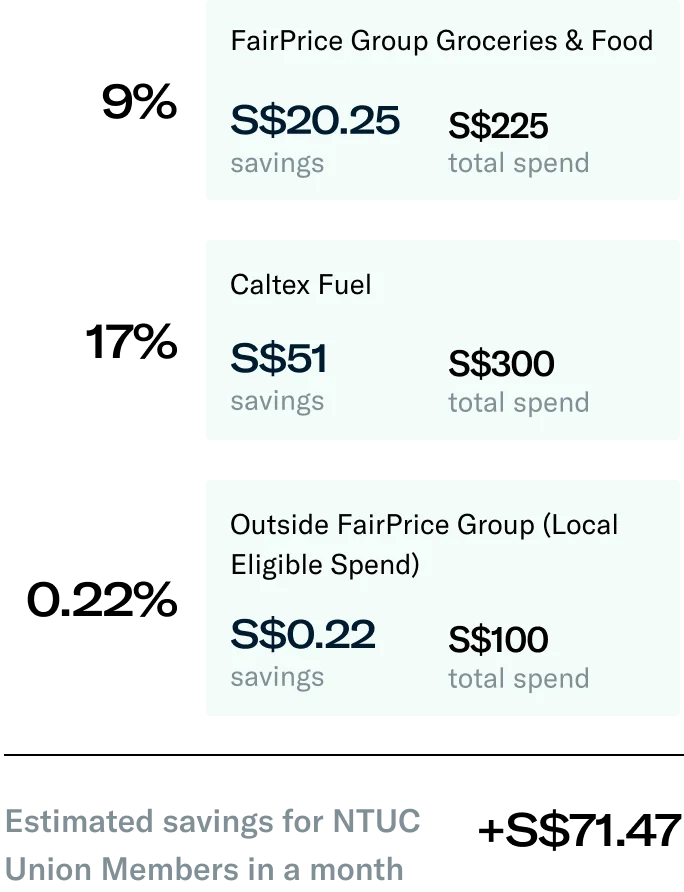

Enjoy smarter savings

You can enjoy significant savings on FairPrice Group groceries and food, Caltex fuel and more.

One savings account

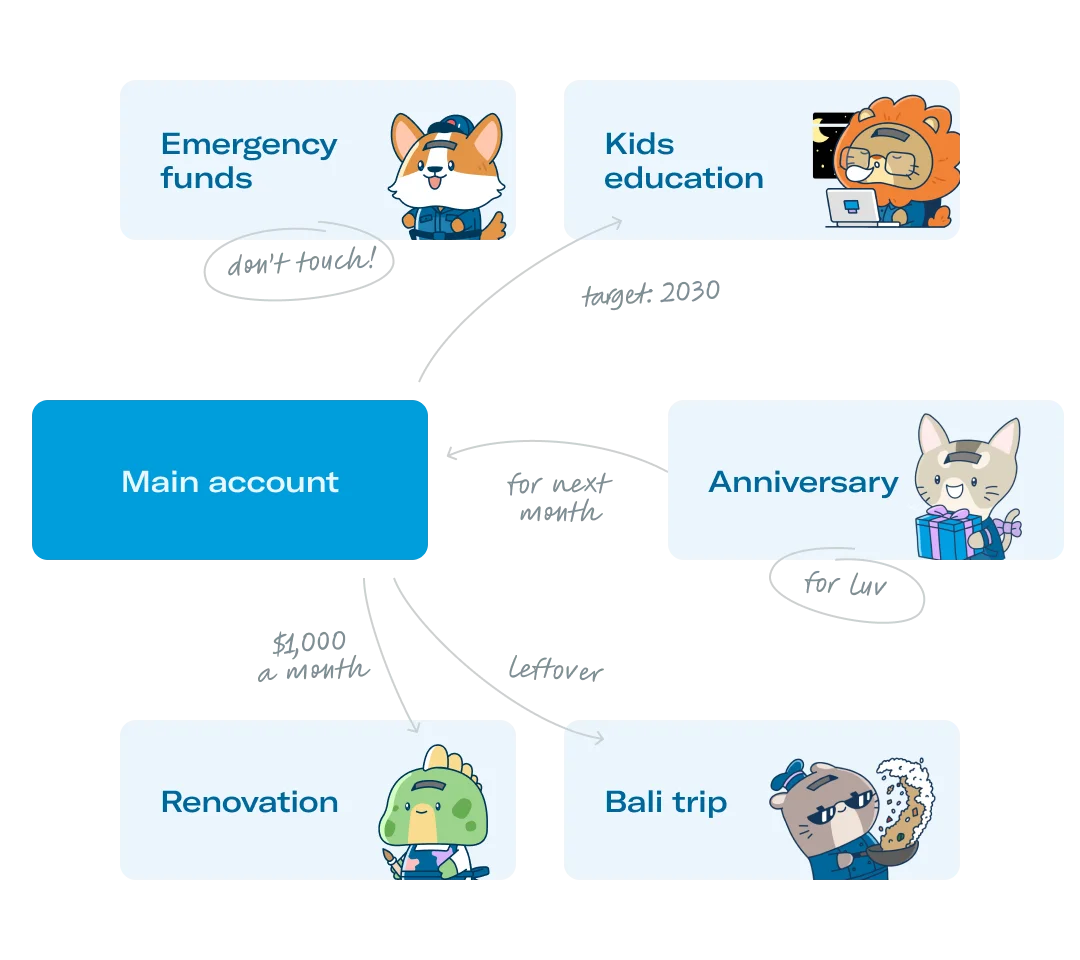

Multiple Savings Pots

Fairytale wedding, renovation project or dream holiday? Move cash from your main account and hatch up to 5 Savings Pots in Trust App. It only takes a few quick taps to start hatching.

Activate Trust Lock

for extra security

Safeguard your Savings Pots from scams! Once locked, you can still add money to it! Unlock your pots securely with Trust card and Trust Key, then wait for a 12-hour cooling period to withdraw.

Fund your account in two ways

Start today with as much, or as little, as you want.

Register for PayNow

Register your mobile number or NRIC/ FIN to receive money directly into your savings account.

Bank transfer using FAST

Send money from another bank account using FAST into your savings account.

Deposit Insurance Scheme

Singapore dollar deposits of non-bank depositors are insured by the Singapore Deposit Insurance Corporation, for up to S$100,000 in aggregate per depositor per Scheme member by law. Foreign currency deposits, dual currency investments, structured deposits and other investment products are not insured.

General Disclaimer for TrustInvest

All investments involve risks, including the possible loss of all or part of your original investment amount. Past performance are not indicative of future performance.