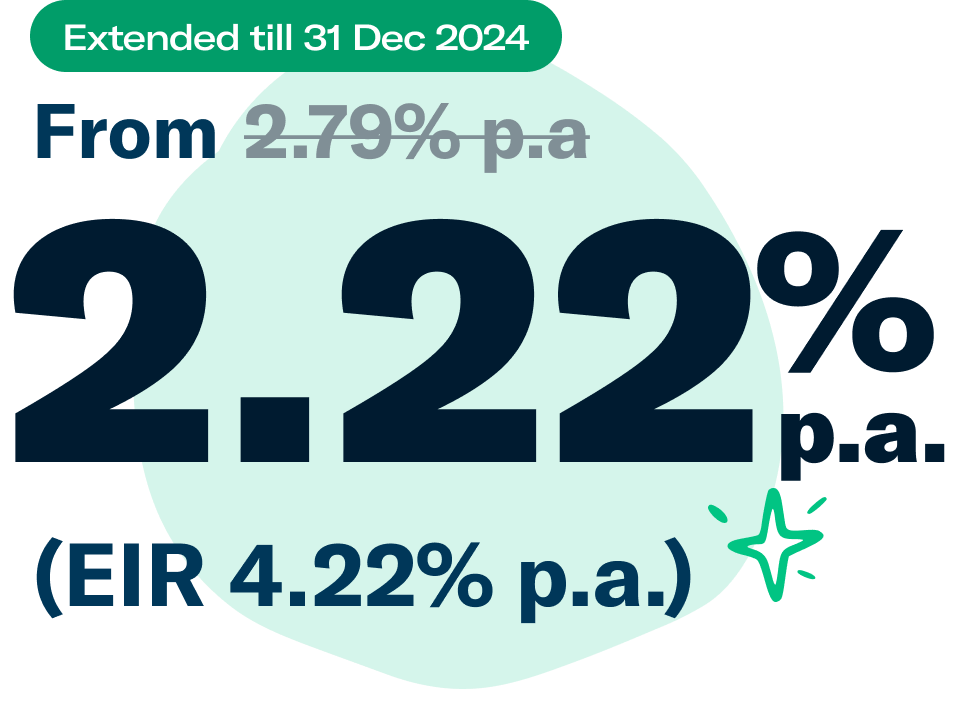

Instant LoanPlan your fairytale weddingfrom 2.22% p.a. (EIR 4.22% p.a.)

Instant Loan repayment calculator

How much do you need?

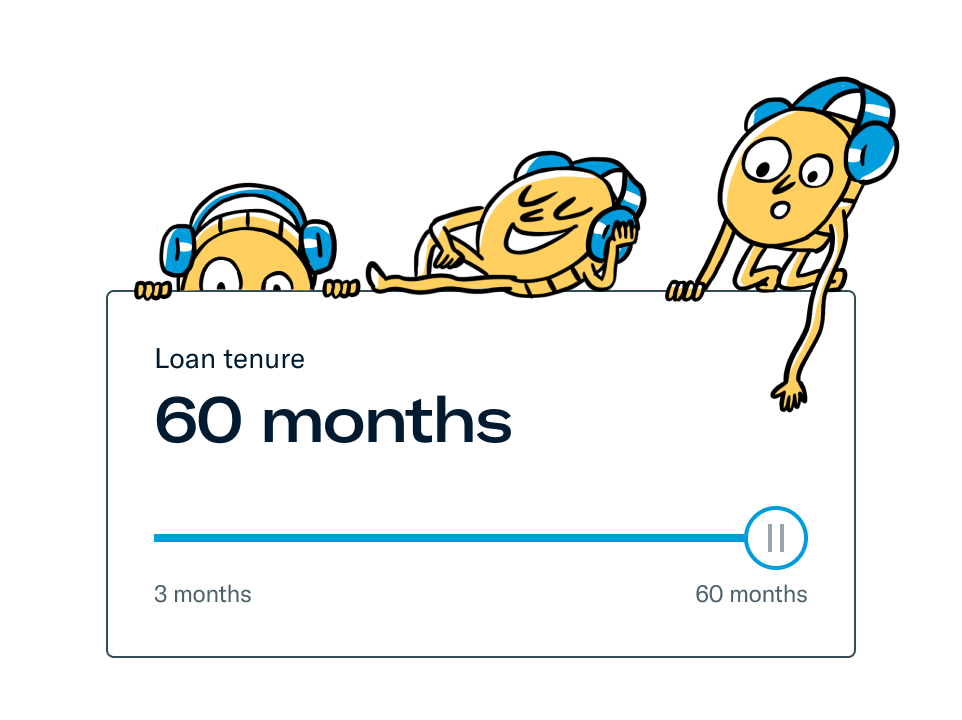

Months to repay

60 months

3 months

60 months

Monthly repayment

S$0.00

Total repayment

S$0.00

Interest

2.22% (EIR 4.22% p.a.)

This is a simplified illustration of monthly repayment and the actual rate offered to you may differ

Say I do with Instant Loan

and get extra cash in 60 seconds

Instant Loan is now open to all new Trust customers

Low rates, no fees

From engagement rings to banquet packages to honeymoon trips, give your wedding budget a boost with our personal loan that has no processing or hidden fees. Seriously!

Flexible repayments

Got your wedding budget all set? Choose your personal loan amount and tenure that suit you best. Repay with fixed instalments over 3 to 60 months - it's your call!

Fast approval,

fast cash

Get your personal loan deposited into your Trust savings account in seconds and turn your dream wedding into a beautiful reality.

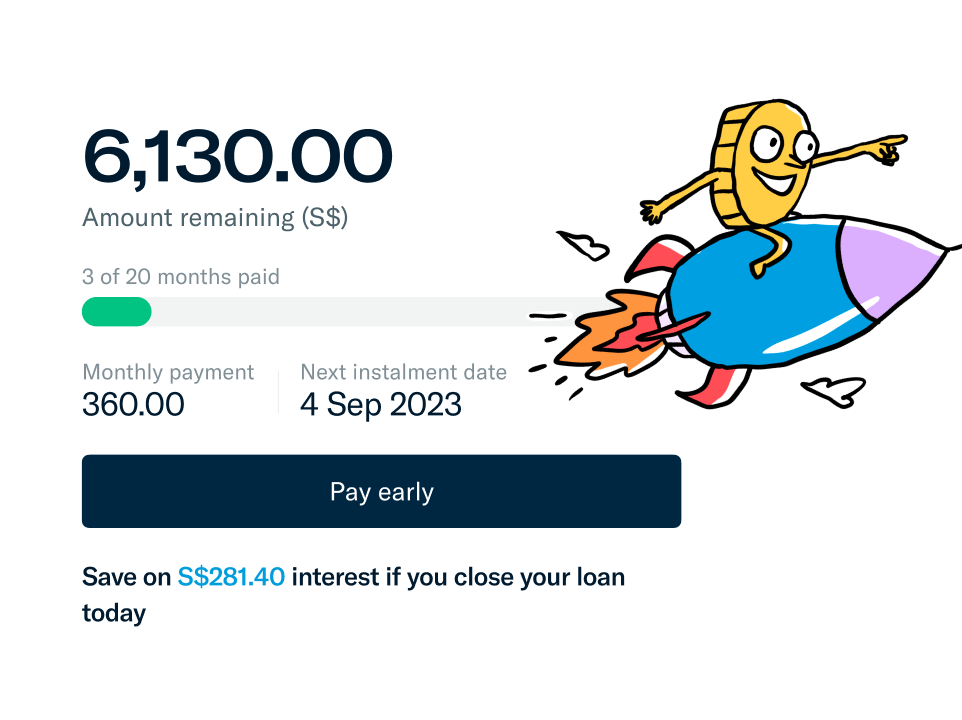

You're in full control

Once your loan is deposited, you can easily view your loan instalments and outstanding remaining amount in Trust App. Plus, you can save on interest when you repay your loan early at any time!

Have questions?

We have answers

Instant Loan is a bank loan in Singapore that allows you to convert a portion of your Trust credit card available credit balance into cash.

For existing customers,

- You must have a Trust credit card to be eligible for Instant Loan and have sufficient available credit limit For new customers,

- Singaporean Citizens, Permanent Residents and Foreigners are currently eligible for Instant Loan.

- All loan applications will be subjected to the bank’s credit checks for loan eligibility.

You can apply for a credit facility if:

- You are between 21 years old and 65 years old; and

- Have an annual income of S$30,000 if Singaporean citizen or permanent resident; or

- Have an annual income of S$60,000 if foreigner with a valid work pass

Get the extra cash you need without the extra fees. Trust has no processing or hidden fees. We only charge a 3% early repayment fee on your outstanding principal amount when you repay early.

Your loan instalment will be charged to your credit card bill on a monthly basis, which you can pay through your credit card statement. Simply tap on Trust App > Money > Credit Card > Pay credit card.

The interest rate offered to you is based on your loan amount, loan tenure and personal credit profile. Hence it may differ from the one displayed on our website.

Disclaimer

*Effective Interest Rate (EIR) is calculated based on a loan amount of S$5,000 and loan tenure of 60 months from 1 Jan 2024. Maximum EIR may be up to 22.34% p.a. based on your personal credit profile

Deposit Insurance Scheme:

Singapore dollar deposits of non-bank depositors are insured by the Singapore Deposit Insurance Corporation, for up to S$100,000 in aggregate per depositor per Scheme member by law.