Our 2024 business progress and launch of TrustInvest

Company

21.02.2025

Trust Bank reaches one million customers and meets its target of becoming the fourth largest retail bank in Singapore by customer numbers

Good progress towards profitability in 2024 with revenue more than doubling and costs up only slightly above inflation

Trust Bank launches investment solution, TrustInvest, in partnership with abrdn to radically simplify investing

Trust has reached one million customers, making it the fourth largest retail bank in Singapore by customer numbers. Though we are one of Singapore’s newest banks, we have already established ourselves as a part of our customers’ daily lives. We got here thanks to our growing community with over 70% of our customers joining us through referrals from other customers.

While one million customers in Singapore is a big milestone for us, we know that becoming a successful and sustainable business isn’t just about customer numbers. It’s essential that customers find value in us and use our products and services as part of their daily lives. And in 2024, we made strong progress on this.

We rolled out several innovative products to meet the needs of our community. With Trust’s wide range of products and services, customers can save, spend, budget, borrow, and insure in easy and delightful ways. This has driven strong usage of our products:

Credit card spend in 2024 was over S$4 billion boosted by the launch of our cashback credit card. Our credit card customers are very active, making an average of 21 transactions each month.

Customers are making significant savings through Trust, earning over S$25 million worth of Linkpoints and saving around S$40 million on foreign exchange fees that they would have otherwise paid on their transactions.

Our deposit balances doubled to S$3.8 billion benefitting from the launch of Singapore’s first fully digital elevated banking experience called Trust+. We are also seeing an increasing number of customers credit their salary to their Trust savings accounts.

Customer loans (which includes credit card balances) increased 149% to S$0.8 billion as we launched balance transfer and split purchase loans.

As a result of this, our revenue for 2024 more than doubled compared with 2023, rising to S$97 million. This was achieved with costs increasing by only slightly more than inflation, showing how scalable our modern, automated platform is. This positions us well on our path towards profitability.

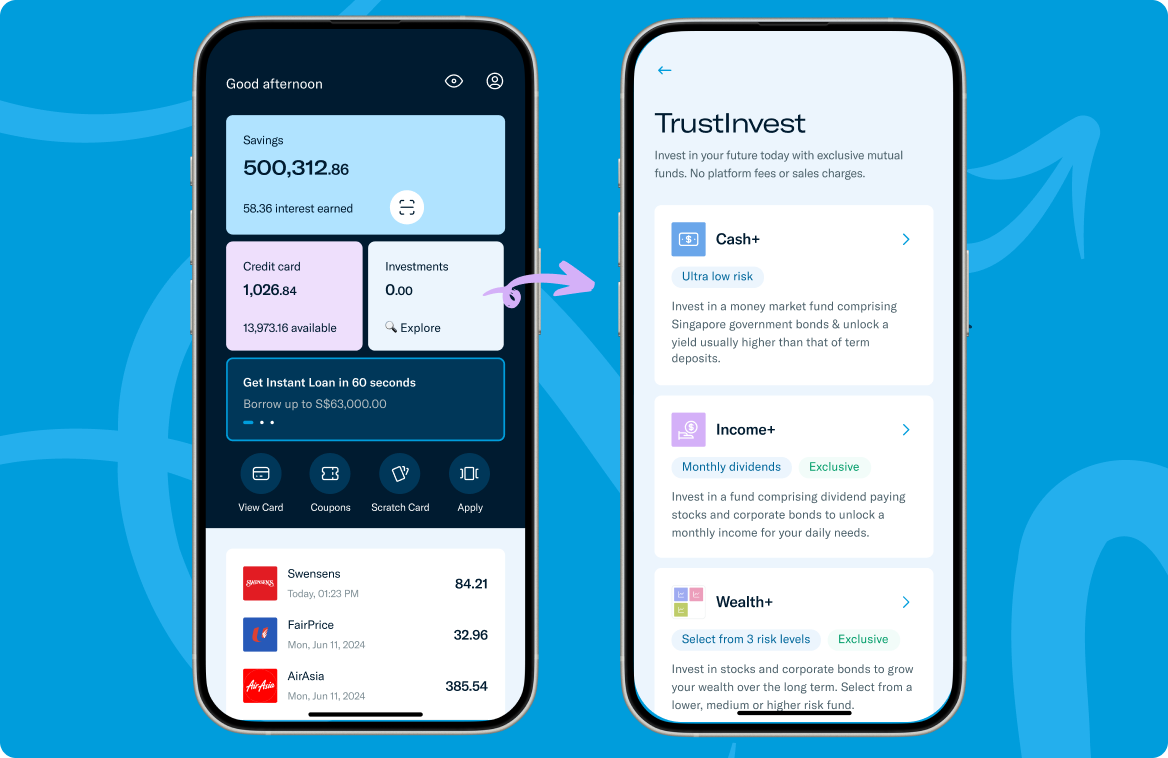

Building a diversified portfolio for long-term financial well-being just got a whole lot easier and less daunting. Today, we’re adding to our already extensive line up of products and services with the launch of TrustInvest.

While most banks have sophisticated investment offerings, our customer research found that getting easy access to investment products remains a challenge for many. Existing offerings on the market are designed for customers with significant amounts to invest, can be complex to understand and may require customers to visit branches or speak to relationship managers to access services.

As a result, rather than investing, many people hold their money in low yielding savings accounts. This means that their hard-earned savings are not keeping up with inflation and lose value each year.

We are here to change this by making investing radically simple. We want to make investing accessible for everyone and not just for a select few.

TrustInvest does this in partnership with global investment company abrdn Investments (“abrdn”), removing the inconveniences that other investment products often come with. TrustInvest is:

Seamless : Self-contained within the Trust App so you don’t have to switch between different platforms to manage your investments. It takes just five taps to start investing.Accessible : The minimum investment amount is just S$100.Simple : From a curated selection of five funds covering a range of goals and risk profiles, investors may benefit from the long-term potential of markets, maximise yield, generate a monthly income, and grow their wealth.Transparent : No platform or sales fees. Only a fund management fee which is clear and upfront. As an added incentive to get started, customers who remain invested until the end of 2025 will receive part of the management fee back.

Through TrustInvest, you can choose from five different funds. With each fund designed to meet differing investment goals and risk appetites, the TrustInvest experience shouldn’t feel overwhelming.

The range of funds consists of a money market fund (Cash+) for investors that want to maximise yield on their cash through a diversified selection of high quality bonds, a dividend paying fund (Income+) for investors that want to generate a monthly income cashflow higher than the rate of inflation through investment, and core funds (Wealth+) with three varying risk levels (Cautious, Moderate and Growth) to support investors in achieving their long-term wealth objectives.

From left to right: Trust’s Head of Invest Rohit Mulani and Chief Executive Officer Dwaipayan Sadhu, and abrdn Investments’ CEO Asia Pacific Ian Macdonald and Head of Wholesale Southeast Asia Natalie Tan

You’ll need a Trust savings account to access TrustInvest. If you don’t have one, don’t worry – opening one just takes a couple of minutes through our award-winning account opening experience.

Once you have your savings account open, select which fund you’d like to invest in and how much to invest.

Now you’re good to go! We’ll take care of the rest, from opening your investment account to depositing the selected amount from your savings account into your investment account.

While a long-term view is important when investing, there’s no lock-in period, so you can sell your investments and withdraw your money any time with no penalty fees.

Getting started with TrustInvest is easy and all within the Trust App

To celebrate the launch of TrustInvest, we’ll be giving customers a scratch card with a sure-win cashback reward of up to S$1,000! Customers can earn one scratch card with a one-time investment of at least S$10,000 using TrustInvest. Each customer can get a maximum of two scratch cards.

See the Trust App for all the details on TrustInvest.

We are Trust, Singapore’s digital bank backed by a unique partnership between Standard Chartered Bank and FairPrice Group.

We aim to make things simple, transparent and rewarding for our customers, using the latest technology to create delightful experiences. Through our wide range of products and services, our customers can save, spend, budget, borrow, invest and insure.

Since our launch in 2022, we’ve become one of the world’s fastest growing digital banks and have over 1 million customers in Singapore. We’ve been named the best digital bank in Singapore by The Asian Banker and best mobile banking App globally by The Digital Banker.

abrdn is a global investment company that helps clients and customers plan, save and invest for the future. Our purpose is to enable our clients to be better investors.

abrdn manages and administers £511bn of assets for clients (as at 31 December 2024).

The capabilities in our global Investments business are built on the strength of our insight – generated from wide-ranging research, worldwide investment expertise and local market knowledge.

Our teams collaborate across regions, asset classes and specialisms, connecting diverse perspectives and working with clients to identify investment opportunities that suit their needs.

As at 31 December 2024, our Investments business manages £370bn on behalf of a broad range of clients around the world - including insurance companies, sovereign wealth funds, independent wealth managers, pension funds, platforms, banks and family offices.

The financial information included in this release relating to Trust Bank is unaudited.

All investments involve risks, including the possible loss of all or part of your original investment amount. The value of any investments and the income from them may fall as well as rise.

This information is not an offer or recommendation to buy or sell units in the fund. It does not consider your specific investment objectives, financial situation or needs. Investors should read the fund prospectus and the product highlights sheet or seek relevant professional advice before making any investment decision. TrustInvest is an investment product and not a bank deposit. All investments are not insured by the Singapore Deposit Insurance Corporation. This advertisement has not been reviewed by the Monetary Authority of Singapore.

Singapore dollar deposits of non-bank depositors are insured by the Singapore Deposit Insurance Corporation, for up to S$100,000 in aggregate per depositor per Scheme member by law. Foreign currency deposits, dual currency investments, structured deposits and other investment products are not insured.