Make saving fun and automated

Product releases

16.12.2024

We all know that putting aside savings for specific goals in life is important. Savings pots are a great way to do this, allowing you to put money into a separate pot for a specific goal. But we also know that creating healthy habits to save regularly can be hard to do.

So based on customer feedback, we recently launched Trust’s innovative Savings Pots to make saving easy, rewarding and of course, fun!

So far, our customers have created over 75,000 Savings Pots as they build healthy savings habits with us.

I

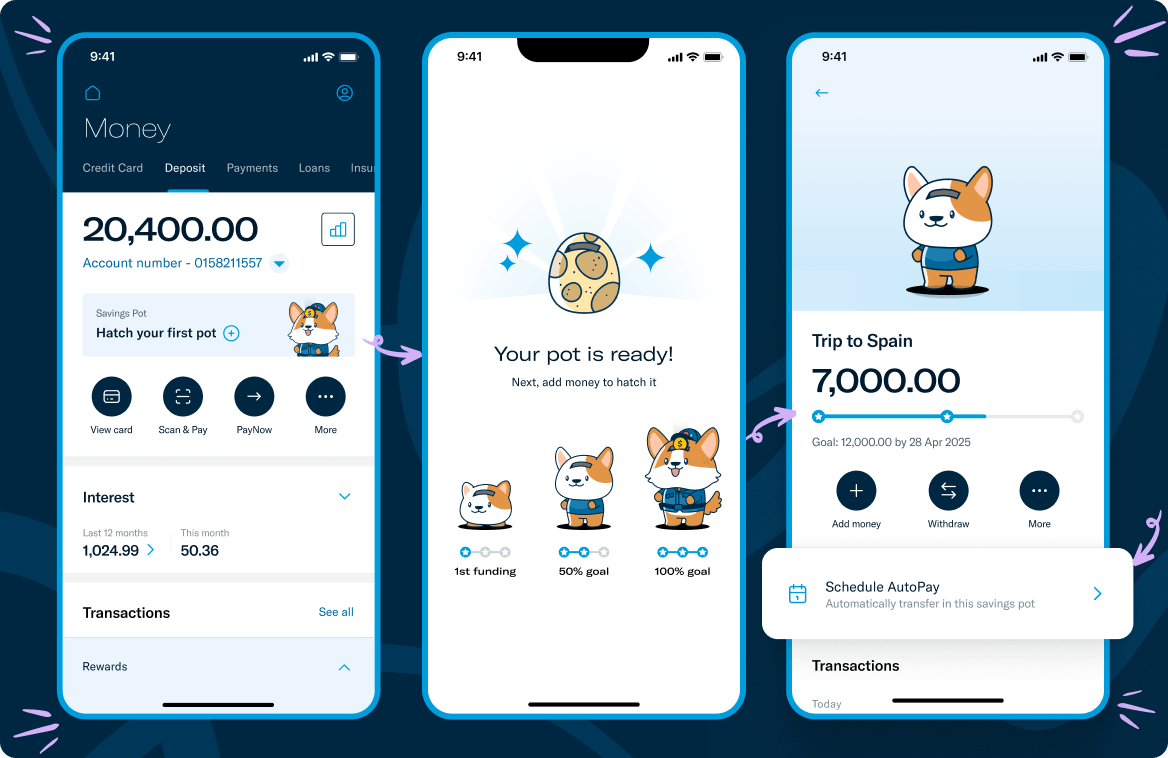

Getting started is super easy. With just three taps, you can create a personalised pot and define your savings goals targets. You can have up to five pots at any one time. The most popular pots so far have been for emergency funds, travel and dream home.

Through our enhanced AutoPay feature, we’ve introduced greater automation, giving you flexibility to choose how much, when and how often you would like to add funds to each pot. Say goodbye to remembering when to top up your Savings Pots. All you need to do is to schedule these recurring top-ups once, and let AutoPay do the rest!

Aside from having real-time visibility on your progress towards your savings goal, Savings Pots have no minimum deposit requirement and no lock-in period! Need cash for an unexpected cash boost? We’ve got you. You can also instantly withdraw funds from your Savings Pots with no penalties incurred.

Beyond being easy and automated, another thing that really sets our Savings Pots apart is the experience which we think is delightfully different.

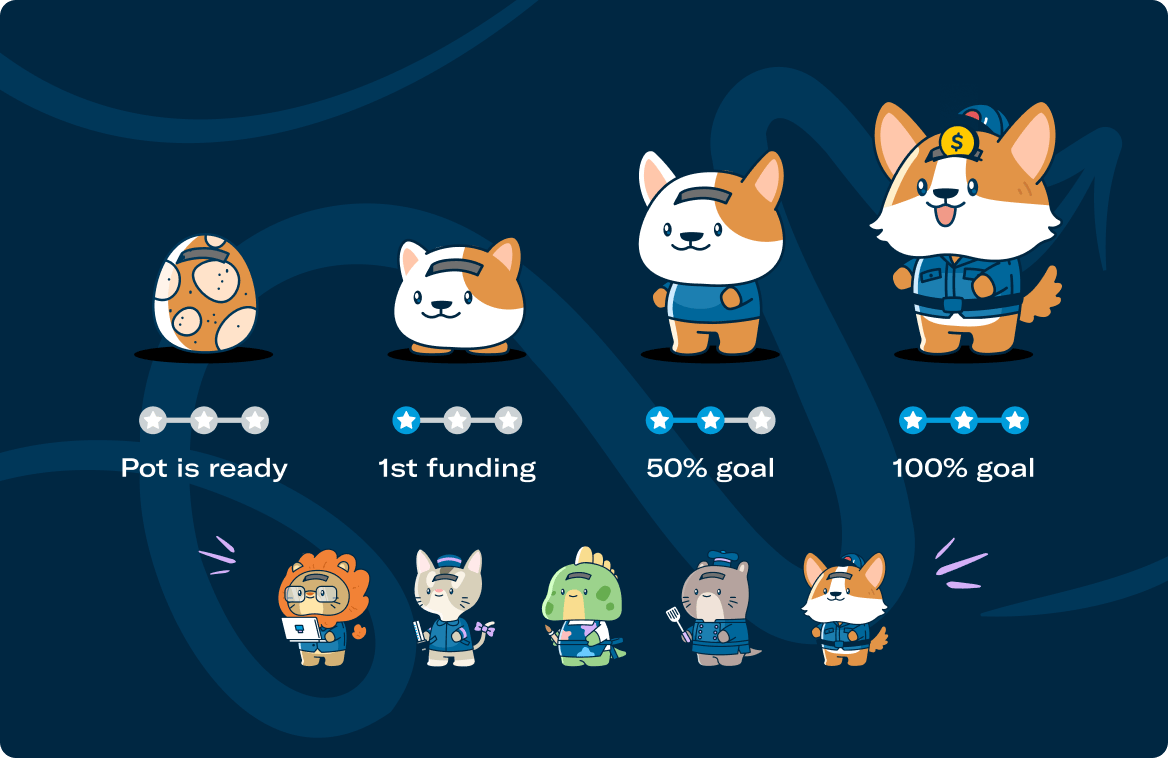

Inspired by the digital pets concept, we have created five lovable Singapore characters – a lion, cat, dog, otter and monitor lizard – to represent each Savings Pot. Starting off from an egg, each character hatches and then grows with your savings, encouraging you to reach your savings goal.

The money you keep in your Savings Pots enjoys the same rewarding interest rates as your Trust Savings Account. This keeps things simple, so you don’t need to think about how to maximise your interest across accounts.

You’ll be pleased to know that funds in Savings Pots also contribute to your eligibility for upgrade to Trust+ exclusive privileges.

*Singapore dollar deposits of non-bank depositors are insured by the Singapore Deposit Insurance Corporation, for up to S$100,000 in aggregate per depositor per Scheme member by law.