Trust Bank launches fractional trading of US stocks & ETFs

Product releases

20.01.2026

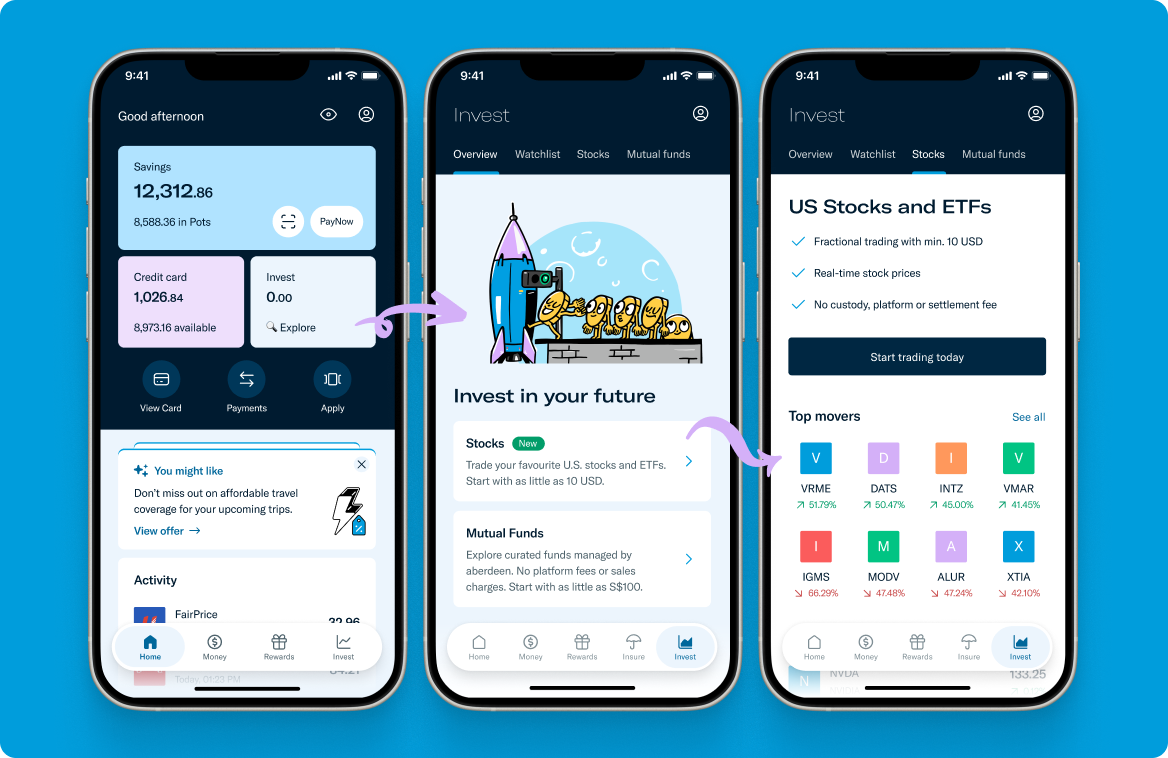

Trust Bank is the first banking app in Singapore to offer fractional trading. Its new trading offering brings together the best of a fully-regulated bank and a fintech.

The bank has partnered with Saxo Singapore to give access to over 7,000 US stocks and exchange-traded funds (ETFs) through the Trust App.

Trust Bank is offering zero commission on trades until 30 June 2026. Customers can win free fractional stock worth up to US$500 when they make their first trade of at least US$1,000.

We’re thrilled to announce the full launch of our trading platform for US stocks and ETFs, now available to all customers on the Trust App. This marks a major milestone in making investing simpler and more accessible.

Trust Bank is the first banking app in Singapore to offer fractional trading. And with its modern, digitally-native experience, Trust brings together the best of a fully-regulated bank and a fintech. Trading is quick, easy, and secure, and the average account opening time is less than one minute, making it extremely fast to get started.

Forget about clunky banking apps or sending funds between your bank account and a separate trading platform. Everything happens seamlessly in the Trust App, with just a few taps to bring money in from your savings account. This allows you to invest quickly and easily.

Images are for illustration purposes only

Fractional trading on the Trust App allows you to own a slice of iconic US companies for as little as US$10. With some popular US companies such as Tesla and Meta trading at over S$500 (~US$ 390) per share, this means you can start with a smaller amount and still build a diversified portfolio.

Since admitting those who joined our waitlist in November 2025, 10,000 pioneering customers have opened their trading accounts. During this period, 45 per cent of customers who traded, made fractional trades. This allowed them to benefit from being able to buy a slice of a US blue chip to suit the amount they want to invest, and shows the appeal of accessible, bite-sized investing.

To deliver a world-class brokerage experience, we’ve partnered with Saxo Singapore. Saxo is a global leader in online trading with over 30 years of expertise and 20 years of experience operating in the Singapore market. Through this partnership, customers can access more than 7,000 tradable US stocks and ETFs, all seamlessly integrated into the Trust App for a frictionless experience.

Beyond this seamless experience, we are also offering customers an extra reason to start trading with TrustInvest. There are no custody fees, no platform fees, and no settlement fees for trading. Plus, customers can enjoy zero commission on trades until 30 June 2026.

Additionally, customers can win free fractional stock worth up to US$500 when they make their first trade of at least US$1,000. This is instantly rewarded through a digital scratch card and is reflected in their portfolio holdings once the market opens. This offer is valid until 31 March 2026.

Open your stocks account today, and start enjoying investing with Trust. Refer to the Trust App for all T&Cs.

The above is for is information and is not an offer or recommendation to buy or sell any investment products. It does not consider your specific investment objectives, financial situation or needs. TrustInvest is an investment product and not a bank deposit. All investments involve risks, including the possible loss of all or part of your original investment amount. You should be aware of the additional financial, regulatory and legal risks that overseas investments carry. This advertisement has not been reviewed by the Monetary Authority of Singapore. Deposit Insurance Scheme: Singapore dollar deposits of non-bank depositors are insured by the Singapore Deposit Insurance Corporation, for up to S$100,000 in aggregate per depositor per Scheme member by law. Foreign currency deposits, dual currency investments, structured deposits and other investment products are not insured.