Key facts sheet for Trust Cashback card

Annual fee charges | None! |

Cash advance fees | Before 1 February 2026 None! (Only applicable to main cardholders as supplementary cardholders cannot take out a cash advance.) From 1 February 2026 An 8% fee will be charged on any cash advance amount drawn that is over S$5 in value. Only applicable to main cardholders as supplementary cardholders cannot take out a cash advance. |

Card replacement fee | None! Normally it’s S$50 plus GST, but we are waiving this fee until further notice. |

ATM withdrawal fee charges | We won’t charge an ATM withdrawal fee when you get a cash advance on your Trust Cashback card or Standard Chartered ATMs. For overseas usage, you may also be able to get a cash advance depending on local regulation. If you’ve activated the overseas ATM withdrawal function on the Trust App and you use your Trust Cashback card overseas to withdraw cash: (a) The foreign currency withdrawal amount will be converted from US dollars into Singapore dollars at the foreign exchange rate provided by Visa with no fee from Trust (and if it’s not in US dollars, it’ll first be converted to US dollars). (b) We’ll process the Singapore dollar amount on your Trust Cashback card. The overseas ATM operator may charge a fee for overseas withdrawals. |

Foreign currency transactions | If you use your Trust Cashback card to pay in a foreign currency (or get a refund in a foreign currency), here’s what will happen: (a) The foreign currency amount will be converted from US dollars into Singapore dollars at the foreign exchange rate provided by Visa with no fee from Trust (and if it’s not in US dollars, it’ll first be converted to US dollars),(b) For a credit transaction, we’ll process the Singapore dollar amount on your Trust Cashback card and (c) For a refund, we’ll credit the Singapore dollar amount on your Trust Cashback card. Please remember that some transactions may be processed overseas even if displayed in Singapore dollars. We will consider these transactions as using your Trust Cashback card in a foreign currency. Check with the retailer if you’re not sure. |

Dynamic currency conversion (DCC) | If your foreign currency transactions (including overseas and online transactions) are converted into Singapore dollars via DCC, this means that the process of conversion and the exchange rate applied will be determined by the relevant DCC service provider and not by us. |

Late payment charges | A late payment charge of S$100 will be charged if the minimumpayment is not received by the due date. |

Interest-free credit period | The interest-free credit period is applicable for your purchases if you choose to make full payment. There is no interest-free credit period for cash advances, and interest accrues from the date the cash advance is posted until it’s paid off in full. |

Minimum payment due | If the minimum payment on your Trust Cashback card statement is not received by the due date, then the minimum payment due applicable is: (a) The greater of either S$50 or 1% of principal, plus (b) interest, fees and charges, and (c) any overlimit amount and past due amount. See below for calculation details. |

Interest for purchases | Effective Interest Rate (EIR): Charged per annum based on a 365-day year (minimum). If payment is not made in full by the due date, interest will be calculated daily from the respective transaction dates for all transactions until the date the payment is received. Please see below for EIR on in annual and daily terms. Annual: 27.9% p.a. Daily: 0.077% |

Interest for cash advance | Effective Interest Rate (EIR): Charged per annum based on a 365-day year (minimum). Interest will be calculated daily on the amount withdrawn from the posting date of the transaction until the date of full payment. Annual: 27.9% p.a. Daily: 0.077% |

Payment order | If full payment is not received by Trust by the due date, we may apply prior payments we received to pay: (a) interest, (b) fees, (c) any balance (principal balance) shown on the statement with the balance attracting the highest interest rate paid off first, then (d) other balances, interest, and fees on the account not shown on the statement (in this order). |

Lost/stolen card liability | If you lose your Trust Cashback card, please notify us immediately by contacting us via the Trust App or by calling us at (+65) 313-87878 (313-TRUST). Your liability will be limited to S$100 if you comply with the section of our general terms on unauthorised transactions. |

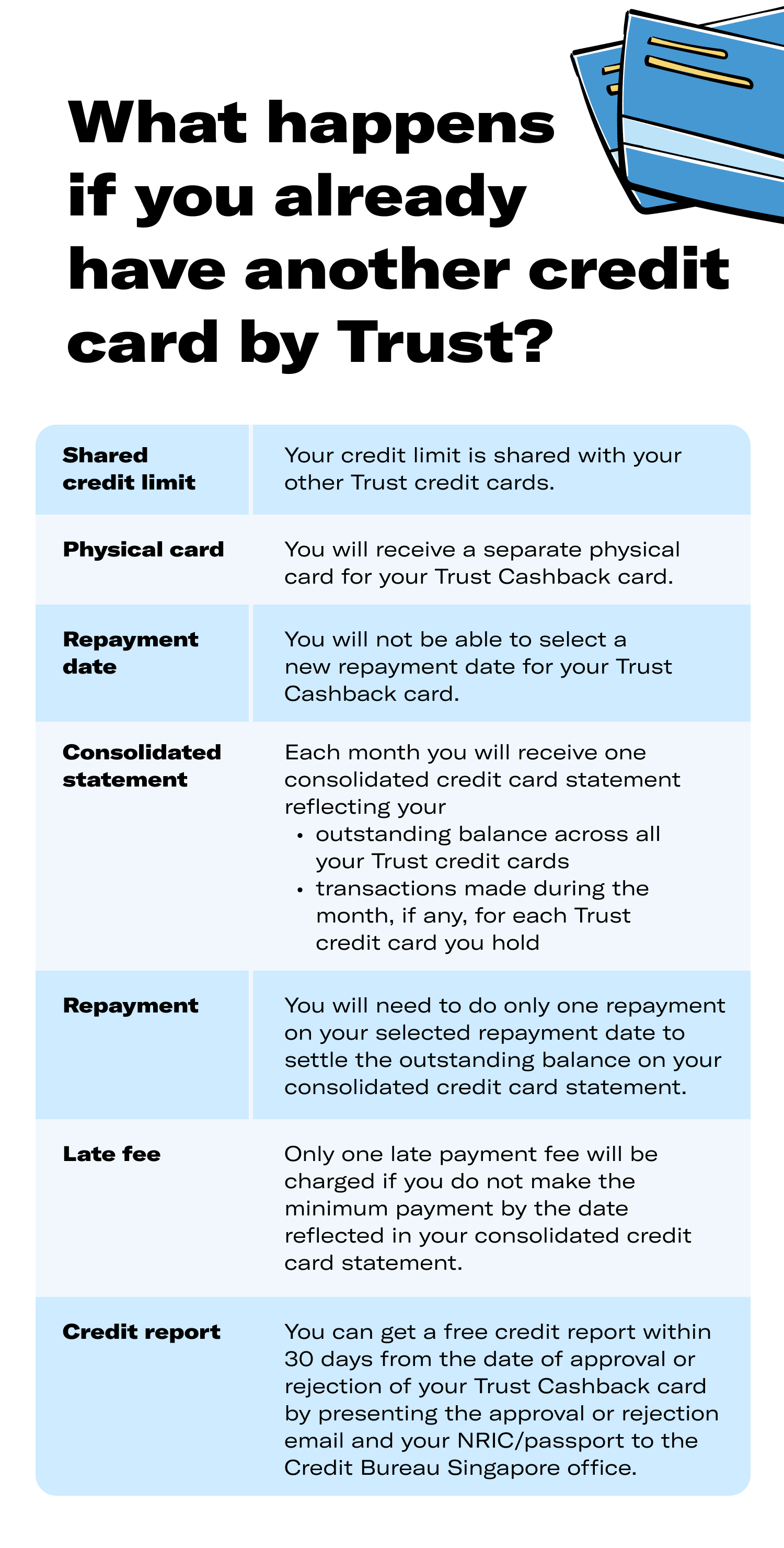

Credit report | If the Trust Cashback card is your first product with us and if you wish to have a free credit report, you may get it within 30 days from the date of approval or rejection of your Trust Cashback card application via the Credit Bureau Singapore website (www.creditbureau.com.sg), or present the approval or rejection email and your NRIC/passport to the Credit Bureau Singapore office. |

If you’ve only paid the minimum payment by the due date as provided in your statement, you must pay interest on the remaining unpaid amount. |

If we do not receive the full amount you owe, or the minimum payment, by the due date: (a) You must pay interest on the unpaid amount. See above for more details on interest rates, (b) You must pay any late payment charges. See above for more details on charges. In addition, we may stop you from charging further amounts to your Trust Cashbackcard. Not paying in full can negatively impact your credit rating and can affect your access to future loans from other lenders. We will also take action to collect any unpaid dues, including legal action if necessary. |

The minimum payment is based on the amount of statement balance. Here’s the calculation:

If your statement balance is less than S$50.00 – you must pay the statement balance |

If your statement balance is equal to or more than S$50.00 – you must pay (a)S$50.00, or (b)1% of principal amount, plus 100% of Instant Loan instalment amount (if any) plus 100% of Split Purchase monthly payment (created before 24 Apr 2025, if any) plus 1% of Split Purchase monthly payment (created on or from 24 Apr 2025, if any) plus 1% of Trust Visa Instalment monthly payments (if any) plus 3% of any Balance Transfer outstanding amount (if any) plus any due interest, fees and charges, any past due and overlimit amount (whichever is higher). |

The minimum payment is based on the amount of statement balance. Here’s the calculation:

If your statement balance is less than S$50.00 – you must pay the statement balance |

If your statement balance is equal to or more than S$50.00 – you must pay (a)S$50.00, or (b)1% of principal amount, plus 3% of Instant Loan monthly principal instalment amount (if any) plus 3% of Split Purchase monthly principal instalments (created before 24 Apr 2025, if any) plus 1% of Split Purchase monthly principal instalments (created on or from 24 Apr 2025, if any) plus 1% of Trust Visa Instalment monthly payments (if any) plus 3% of any Balance Transfer outstanding amount (if any) plus any due interest, fees and charges, any past due and overlimit amount (whichever is higher). |

1. Cashback refers to the cashback credited to your Trust Cashback card account in accordance with the terms of the Trust Cashback card product terms. Cashback earned cannot be transferred or withdrawn as cash. It can only be used to offset your outstanding balance. Cashback on Eligible Spend is awarded only when the Eligible Spend is over S$1. Cashback is rounded to the nearest 2 decimal places. For example, if you are a new to Trust customer and make an Eligible Spend of S$1.50, then you will receive cashback of S$0.02. Actual overall cashback earned varies depending on spend criteria you meet.

2. Preferred categories for cashback: Transactions made on Trust Cashback card are categorized according to the Merchant Category Code (“MCC”), and the MCC determines which preferred category the transaction falls under. MCC is a four-digit number assigned to a merchant (the business/organisation you paid) by the merchant’s bank. Trust does not decide the merchant’s MCC. 🙏

Dining

MCC | Description |

5462 | Bakeries |

5499 | Miscellaneous Food Stores – Convenience Stores and Specialty Markets |

5811 | Caterers |

5812 | Eating Places and Restaurants |

5814 | Fast Food Restaurants |

Shopping

MCC | Description |

4812* | Telecommunication Equipment Including Telephone Sales |

5137* | Men’s, Women’s and Children’s Uniforms and Commercial Clothing |

5262 | Marketplaces |

5309 | Duty Free Stores |

5310 | Discount Stores |

5311 | Department Stores |

5331 | Variety Stores |

5399 | Miscellaneous General Merchandise |

5611 | Men’s and Boys’ Clothing and Accessories Stores |

5621 | Women’s Ready-To-Wear Stores |

5631 | Women’s Accessory and Specialty Shops |

5641 | Children’s and Infants’ Wear Stores |

5651 | Family Clothing Stores |

5655 | Sports and Riding Apparel Stores |

5661 | Shoe Stores |

5681 | Furriers and Fur Shops |

5691 | Men’s and Women’s Clothing Stores |

5712* | Equipment, Furniture and Home Furnishings Stores (except Appliances) |

5732* | Electronics Sales |

5699 | Miscellaneous Apparel and Accessory Shops |

5940 | Bicycle Shops – Sales and Service |

5941 | Sporting Goods Stores |

5942* | Book Stores |

5944 | Jewellery Stores, Watches, Clocks, and Silverware Stores |

5946 | Camera and Photographic Supply Stores |

5947 | Gift, Card, Novelty and Souvenir Shops |

5948 | Luggage and Leather Goods Stores |

5977^ | Cosmetic Stores |

Travel

MCC | Description |

3000 – 3308 | Various Airlines |

3501 – 3839 | Various Hotels |

4411 | Steamship and Cruise Lines |

4511 | Airlines and Air Carriers (Not Elsewhere Classified) |

4582 | Airports, Flying Fields, and Airport Terminals |

4722 | Travel Agencies and Tour Operators |

4723 | Package Tour Operators – Germany Only |

5962 | Direct Marketing – Travel-Related Arrangement Services |

7011 | Lodging – Hotels, Motels, Resorts, Central Reservation Services (Not Elsewhere Classified) |

7012 | Timeshares |

7033 | Trailer Parks and Campgrounds |

Wellness

MCC | Description |

5912 | Drug Stores and Pharmacies |

5977^ | Cosmetic Stores |

5997 | Electric Razor Stores – Sales and Service |

7230 | Beauty and Barber Shops |

7297 | Massage Parlors |

7298 | Health and Beauty Spas |

7997 | Membership Clubs (Sports, Recreation, Athletic), Country Clubs, and Private Golf Courses |

8031 | Osteopaths |

8041 | Chiropractors |

8049 | Podiatrists and Chiropodists |

Transport

MCC | Description |

3351 – 3441 | Various Car Rentals |

4111 | Local and Suburban Commuter Passenger Transportation, Including Ferries |

4112 | Passenger Railways |

4121 | Taxicabs and Limousines |

4131 | Bus Lines |

4457 | Boat Rentals and Leasing |

4784 | Tolls and Bridge Fees |

4789 | Transportation Services (Not Elsewhere Classified) |

5521 | Car and Truck Dealers (Used Only) Sales, Service, Repairs, Parts, and Leasing |

5541 | Service Stations (with or without Ancillary Services) |

5542 | Automated Fuel Dispensers |

5552 | Electric Vehicle Charging |

5983 | Fuel Dealers – Fuel Oil, Wood, Coal, and Liquefied Petroleum |

7512 | Automobile Rental Agency |

7513 | Truck and Utility Trailer Rentals |

7519 | Motor Home and Recreational Vehicle Rentals |

7523 | Parking Lots, Parking Meters and Garages |

Entertainment

MCC | Description |

4899 | Cable, Satellite and Other Pay Television/Radio/Streaming Services |

5733 | Music Stores – Musical Instruments, Pianos, and Sheet Music |

5735 | Record Stores |

5813 | Drinking Places (Alcoholic Beverages) – Bars, Taverns, Nightclubs, Cocktail Lounges, and Discotheques |

5815 | Digital Goods Media – Books, Movies, Music |

5816 | Digital Goods – Games |

5945 | Hobby, Toy, and Game Shops |

7832 | Motion Picture Theatres |

7841 | DVD/Video Tape Rental Stores |

7922 | Ticket Agencies and Theatrical Producers (Except Motion Pictures) |

*From 1 March 2026, the following MCCs will be added to the Shopping category: 5732, 5942, 5137, 5712, and 4812.

^From 1 March 2026, the following MCC will be removed from the Wellness category and added to the Shopping category: 5977.

3. Eligible Spend means Local Eligible Spend and Foreign Eligible Spend.

Local Eligible Spend refers to all Visa transactions on your Cashback card in Singapore Dollars, and where the transaction is processed in Singapore, excluding ineligible transactions.

Foreign Eligible Spend refers to all Visa transactions made on your Cashback card that are not in Singapore Dollars, or where the transaction is processed outside of Singapore (including transactions that are converted into Singapore dollars via Dynamic Currency Conversion (DCC)), excluding ineligible transactions.

See our FAQs and Cashback card Product Terms for the list of ineligible transactions.

4. You can’t change the starting month of each quarter after you have signed up.

5. Minimum monthly spend refers to required Eligible Spend in a calendar month to earn cashback on your preferred category.

6. Eligible spend will be counted towards your minimum spend, based on your transaction date. Transaction date means the date the transaction is authorised/charged to your Trust Cashback card. For example, if the transaction is charged on 30th September but completed and posted on 2nd October 2024, the transaction is counted towards your September 2024 minimum monthly Spend.

7. Information you see on ATMs about your account (if available), for example your balance, may not show the most up to date balance at that time. If you are unsure, you shouldn’t proceed with the withdrawal.

This Key Facts Sheet is correct as at the date last updated.

Last updated on: 28 January 2025, Version: 15